Countries like India should develop plans to manage the physical and transition risks of climate change © Abbie Trayler-Smith / DfID

Across Asia Pacific, central banks and financial supervisors are beginning to respond to the call on climate action. An increasing number of guidelines have been issued by regulators in the region to help financial institutions manage the physical and transition risks brought about by climate change.

But looking into these regulatory expectations, how well have these risks been effectively identified and managed to avoid climate disaster? What actions have been taken or should be taken to manage climate-related financial risks in the region?

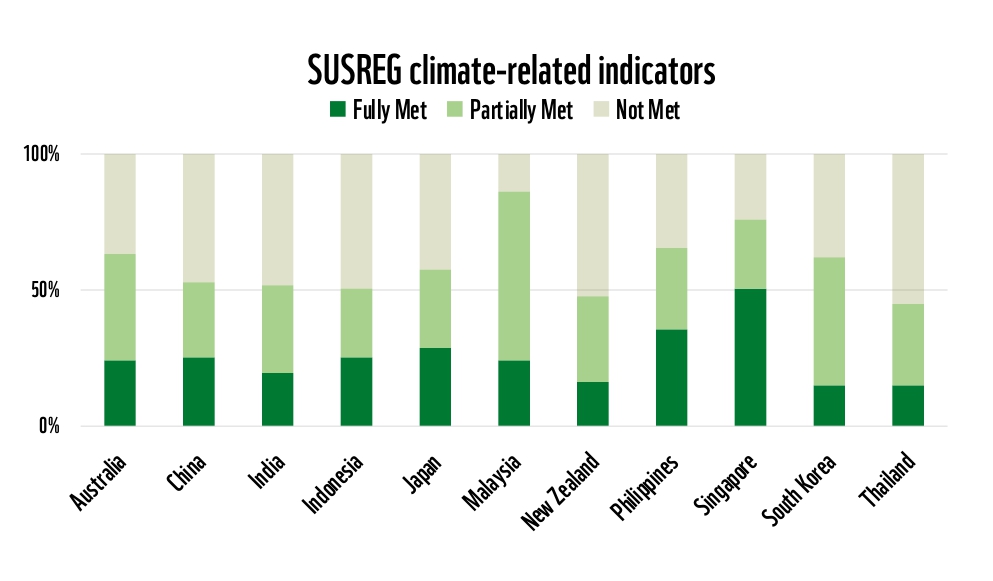

Using the latest results from WWF’s Sustainable Financial Regulations and Central Bank Activities (Susreg) tracker, we can see how financial regulators, supervisors and central banks in the region have integrated climate considerations into their mandates and practices.

Susreg uses 87 indicators to assess regulatory performance with regard to climate change, ranging from supervisory expectations on climate to enabling an environment that supports regulatory progress. Overall, the assessment has found three countries leading in the region: Singapore, Malaysia and the Philippines. Singapore has fully met half of Susreg’s climate-related indicators and Malaysia has covered the greatest range. However, as figure 1 shows, most countries in the region have only managed to fully or partially meet around 50% of these indicators.

Response to physical risks

When the Susreg results are overlaid with the country’s physical vulnerability scores from the ND-GAIN Index (as in figure 2), we see that there is even greater urgency for certain countries to strengthen their regulations in the face of upcoming physical risks. We found that the majority of countries in Asia Pacific achieved below 50% in the strength of their regulatory policies and practices on climate even though most countries in this range suffer a relatively high climate physical risk, particularly in India, Indonesia, the Philippines and Thailand.

Although financial regulation is not the sole factor in addressing climate-related risks within a country, it plays a large role in ensuring economic and financial stability amidst climate chaos. In a country facing high physical risk, financial authorities are encouraged to expand the use of climate scenario analysis and stress tests for macroprudential purposes in order to have a system-wide perspective.

From our assessment, only a select number of countries in the region have conducted comprehensive stress testing or scenario analysis exercises (see figure 3). Stress testing is useful in understanding how to improve the resilience of the financial sector through macroprudential policy, as well as identifying systemic risks, macroeconomic impact and opportunities for climate adaptation finance. Without comprehensive stress tests and scenario analysis, supervisors could be flying blind to risks that are actually likely to materialise in the coming decades, as well as the actions to address them.

Technical assistance to build the capacity in areas such as catastrophe and macroeconomic modelling and climate stress tests would help to build the resilience of countries with better risk management. We see three stages of advancing regulation and stress-testing:

- financial regulators that are at the initial stage of risk assessment should at least capture the direct impacts (physical damages) and may rely on historical damage data and refine with more detailed hazard, exposure and vulnerability data when available (eg urban flood assessment of Jakarta);

- financial regulators that have conducted such assessments could strive to use finer spatial location data, innovate modelling techniques based on artificial intelligence, and analyse short- and long-term indirect impacts occurring through main transmission channels to the economy and the financial sector;

- financial regulators could also consider compound shocks beyond climate change in physical climate risk assessments (eg joint typhoon and pandemic shocks in the Philippines), as well as the feedback loop between biodiversity loss and climate change.

Furthermore, countries that are leading in green financial regulation should incentivise the development of disaster risk financing instruments and mobilisation of capital by financial institutions into high-impact target sectors which are significantly under-capitalised in Asia, such as early-stage climate adaptation and mitigation technology, and nature-based solutions. Examples include the Monetary Authority of Singapore’s climate solutions design grant and Convergence Blended Finance.

Response to transition risks

Aside from physical hazards, climate risks could also affect the economy through transition risk drivers arising from the transition to a low-carbon economy. Based on data from a World Bank report on strategies for fossil-fuel dependent countries, most countries in the Asia Pacific region face a high exposure to climate transition risks in terms of carbon intensity of manufacturing exports, fossil fuel export, committed power emissions and expected resource rents as a proportion of GDP. They also have low resilience in terms of their degree of preparedness ranging from macroeconomic stability and technology adoption to their position on the global supply curve.

Combined with results from the most recent Susreg assessment, a pattern emerges in which emerging economies that are G20 members, such as India and Indonesia, are the most exposed and at the same time not as prepared from a financial regulatory perspective to face transition risks (see Figure 4).

With countries like the UK moving towards making disclosure of climate transition plans mandatory, we envisage economies in Asia Pacific will follow suit. Financial supervisors could start by requiring financial institutions to disclose their decarbonisation commitment and how commitments will be met through clear decarbonisation trajectories and timelines. More work is needed to localise legally binding science-based net zero and nature-positive targets which are translated into publicly available sector-specific transition pathways suitable for the region. This would enable financial institutions and large or listed companies to adopt and disclose targets and plans on a mandatory basis.

Going forward, countries better equipped with technical expertise and have systemically important financial institutions could include business model transformation, as well as transition governance and operations (including examining counterparties’ transition plans) by financial institutions, as part of their supervisory expectations.

Central banks and financial regulators that have set net-zero roadmaps could promote liaison and coordination among peers and stakeholders, and publish transition plans to achieve net zero in their portfolio management. Better understanding of differentiated transition pathways for different sectors and geographical regions would facilitate more accurate management of transition risks.

There are many key actions that could be taken to address transition risk in the short-horizon. First, WWF’s criteria for credible climate and nature transition plans can be adapted to drive ambition and consistency in transition plan development in line with best practices and international standards. Second, utilising published transition plans will enable regulators to assess the transition risk profile of surveyed financial institutions and companies and make any adjustments to capital or liquidity requirements to reduce those risks.

And third, targeted and coherent policy measures can be introduced to help facilitate the near-term phase out of high-carbon activities, such as developing market models and key inputs to support low-carbon technologies. This can include developing a list of “always environmentally harmful” sectors that will need to be further enhanced over time.

Conclusion

The heat is rising so the window for action is closing. In Asia, a lot more could be done to mitigate the region’s high vulnerability towards climate physical and transition risks. A significant step would be to conduct a comprehensive stress testing exercise and clearly set expectations that financial institutions will manage identified risks.

Acting pre-emptively and with full force will help central banks, regulators, and supervisors safeguard their ability to fulfil their primary mandates into the future. Because only an urgent and responsible system-wide transformation can avert the worst impacts of climate change.