SUSREG TRACKER

Menu

Building on its experience of working with a wide range of financial stakeholders, WWF ´s Greening Financial Regulation Initiative has developed an online framework (SUSREG Tracker) to assess the integration of environmental & social considerations in regulatory and supervisory practices, as well as in central banking activities and other measures helps redirect financial flows towards more sustainable practices.

The main objectives of the SUSREG Tracker are to:

With this online tool, we aim to facilitate easy knowledge sharing between financial institutions, building on existing good practices and improving understanding of how climate-related and environmental risks can be integrated in central banks’ and financial supervisors’ activities.

SUSREG Tracker provides practical guidance on the integration of environmental & social considerations in financial regulations, supervisory expectations and monetary policy.

More specifically, it:

The development of the SUSREG framework has been led by WWF´s Greening Financial Regulation Initiative, in collaboration with many sustainable finance experts in important WWF national offices globally.

Various feedback was received also from a broad network of external stakeholders, ranging from academia and think-tanks to financial supervisors and central banks themselves.

The SUSREG framework currently focuses on banking and insurance supervision. In the future, it will be expanded to cover other key parts of the financial system, such as capital markets and asset management.

The assessment framework is structured around three key pillars, covering the various aspects of banking supervision and central banks’ activities, as well as the creation of an enabling environment for sustainable finance.

Banking & insurance supervision

This section assesses the maturity of supervisory expectation in using various tools and measures to ensure both the safety and soundness of individual banks, (re)insurance companies and the financial system stability, with regards to climate, environmental, and social risks. It also includes measures that regulators and supervisors themselves can take to show leadership and better understand these risks and their implications for the financial sector.

Central banking

This section assesses various measures that central banks can take to address climate, environmental, and social risks, in keeping with their key mandates of ensuring money supply and price stability. It also includes measures that central banks can take to show leadership and better understand these risks and their implications.

Enabling environment

This section assesses the maturity of the environment required that would be key for the financial sector to fully support the transition to a low-carbon, resilient and sustainable economy. Some of these measures may be outside the remit of central banks or financial supervisors.

The assessment against SUSREG indicator(s) leads to either a positive, partial or negative result. In addition, the results clearly display the scope of the underlying measure(s) assessed: either only applicable to climate-related risks, to climate-related and broader environmental risks, or to the entire range of environmental & social risks.

Two layers of assessment were pursued: regulation enforceability level and coverage. In the first stage, WWF assesses the enforceability to determine whether a certain expectation towards supervised entities is mandatory and enforced. The second stage assesses whether the scope of the source of information encompasses all supervised entities or only specific segments of supervised entities.

In the absence of regulations or guidelines issued by the financial regulator on sustainable banking and insurance, WWF considered relevant guidelines issued by either the securities commissions or stock exchanges, national banking/insurance associations, or other industry-led bodies, where available. Although regulations issued by the stock exchange or securities commissions and guidelines issued by the national banking association or other industry-led bodies are considered important drivers of change, in our view the issuance of stringent and mandatory regulations is the most conducive solution to the uniform integration of environmental and social considerations within the banking and insurance sector, and therefore should be actively pursued.

While certain supervisory expectations are only applicable to financial institutions of a certain size, SUSREG assessment does not differentiate this distinction and assesses the substance of the supervisory expectations regardless of their coverage in terms of size of financial institutions.

ASSESSMENT OF THE EUROPEAN UNION (EU)

Given the specific conduct of banking and insurance supervision and monetary policy in the EU, the results of our assessment of individual European countries should be considered in parallel to the results of our assessment of the EU. The Eurosystem comprises the ECB and the national central banks of the EU Member States whose currency is the euro. Under the Eurosystem, the ECB is in charge of defining the monetary policy while national central banks should implement it. Therefore, the assessment results for monetary policy measures in individual EU countries that have adopted the euro is marked as “N/A”, and it is necessary to refer to the assessment performed at the EU level.

The only exception to this rule is the management of foreign exchange reserves, over which national central banks have full autonomy.

All the EU-level regulations in force will be applied to EU country-level assessments. In the case of the EU directives (e.g., Corporate Sustainability Reporting Directive) that have not yet taken effect in the EU-regulated markets, we consider them as “partially met” at the country level. Similarly, we include proposed and draft EU regulations and directives at the country level, with a maximum score of “partially met”. In principle, we do not use guidelines such as those issued by EBA/ECB/EIOPA in the country-level assessment,22 unless the financial supervisor specifically mentioned that it will be applying the guidelines as part of its supervision.

ASSESSMENT OF THE UNITED STATES OF AMERICA (USA)

This year we include two states (California and New York) in addition to the national (federal) assessment for the USA. State jurisdictions can have their own regulation and supervisory agencies (such as the New York Department of Financial Services or the California Department of Insurance), although they do not have fully-fledged central banks (in the semi-decentralised Federal Reserve Bank system, regional Federal Banks such as New York and San Francisco follow the federal monetary policy and act as delegated supervisors). Since federal regulation in the USA assessment applies to all its states, individual states such as California and New York may only have SUSREG assessments equal to or higher than the USA assessment (when local initiatives go further than national policy).

Please note that for insurance regulation and supervision, the situation in the USA is fragmented and relatively complex. In principle, the national insurance supervisor is the Treasury Department’s Federal Insurance Office (FIO). In practice though, the FIO plays a limited role, such as identifying any gaps in the state-based regulatory system. Actual insurance regulation and supervision are applied state-by-state, sometimes with wide discrepancies in the rules and practices observed between individual states. The NAIC (National Association of Insurance Commissioners) is an important national forum that can make recommendations and promulgate model regulations and laws on occasion, which then form the basis of many states’ supervisory rules and procedures. USA states can choose to adopt NAIC proposals, in some cases automatically

In performing the assessments, WWF has considered the following sources (non-exhaustive list):

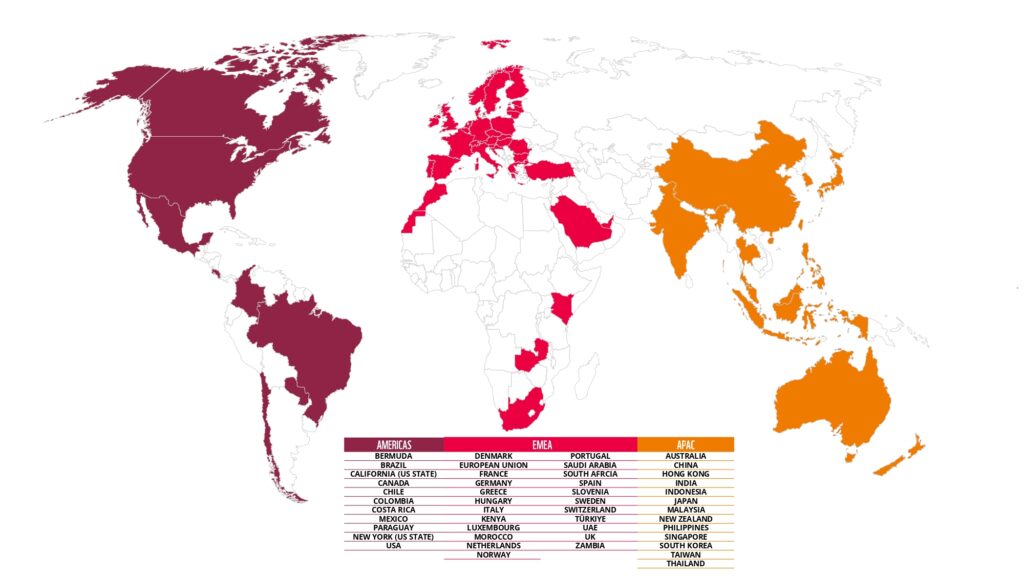

The assessment has expanded from 38 jurisdictions in 2021 to 47 jurisdictions in 2022 across the Americas, EMEA (Europe, Middle East, and Africa), and APAC (Asia Pacific). These jurisdictions cover more than 88% of the global GDP and 72% of global GHG emissions, and 11 of the 17 most biodiversity rich jurisdictions in the world.

Most of the jurisdictions are members and observers of the Basel Committee on Banking Supervision (BCBS), the International Association of Insurance Supervisors (IAIS), and the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). Forty-two jurisdictions have been assessed for both banking and insurance, and out of the jurisdictions, two (Saudi Arabia and Zambia) have been assessed only for banking and another two (Bermuda and Taiwan) only for insurance.

©️ 1986 Panda Symbol WWF – World Wide Fund For Nature (formerly World Wildlife Fund) | ®️ “WWF” is a WWF Registered Trademark